File Info

| Exam | General Securities Representative Qualification Examination (GS) |

| Number | Series 7 |

| File Name | FINRA.Series 7.PracticeTest.2018-01-04.400q.tqb |

| Size | 1 MB |

| Posted | Jan 04, 2018 |

| Download | FINRA.Series 7.PracticeTest.2018-01-04.400q.tqb |

How to open VCEX & EXAM Files?

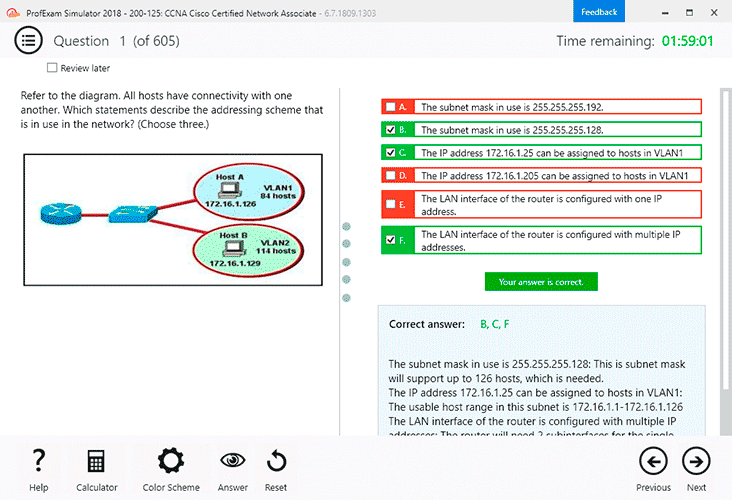

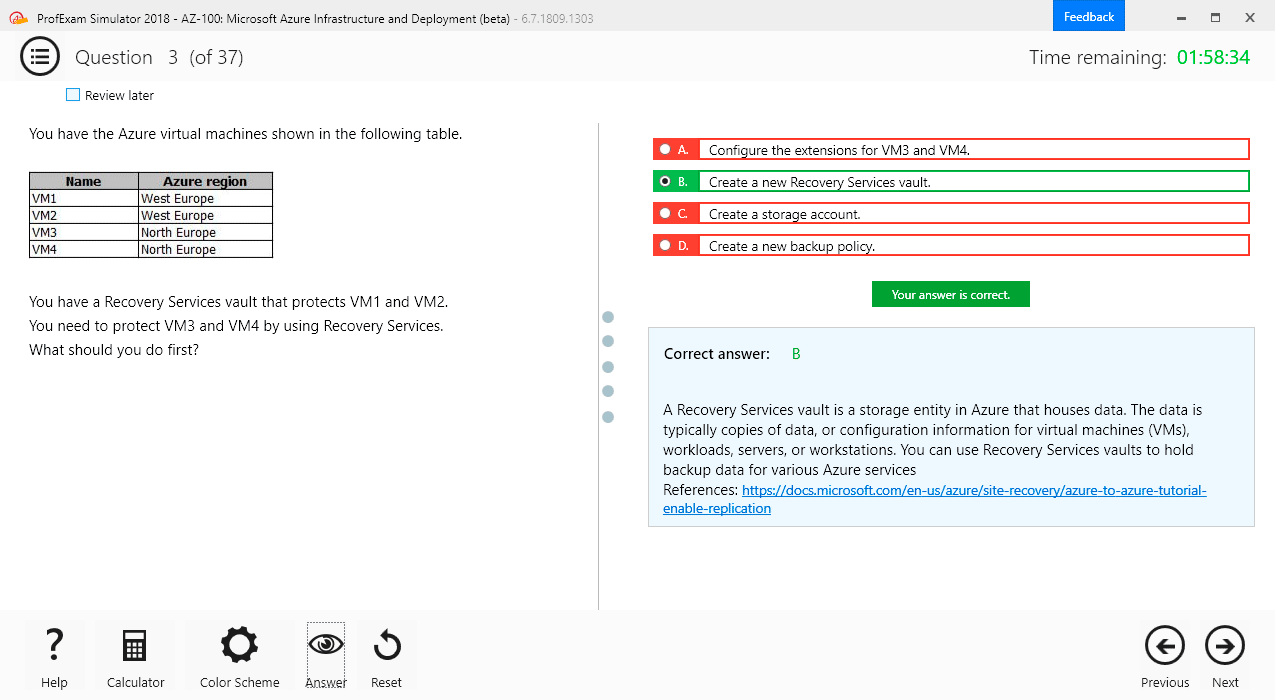

Files with VCEX & EXAM extensions can be opened by ProfExam Simulator.

Coupon: MASTEREXAM

With discount: 20%

Demo Questions

Question 1

Which of the following preferred issues is likely to fluctuate most in value?

- cumulative preferred

- callable preferred

- convertible preferred

- broker preferred

Correct answer: C

Explanation:

convertible preferred. Because of the conversion feature, convertibles are more closely linked to the price of the common stock. In addition, since the dividend rate on convertible preferred is usually lower than other preferred issues, the convertibles are more sensitive to interest rate fluctuations. convertible preferred. Because of the conversion feature, convertibles are more closely linked to the price of the common stock. In addition, since the dividend rate on convertible preferred is usually lower than other preferred issues, the convertibles are more sensitive to interest rate fluctuations.

Question 2

Which of the following rights does an ADR holder not have?

- preemptive rights

- the right to vote for your mother-in-law as a board member

- the right to transfer ownership

- the right to see financial statements

Correct answer: A

Explanation:

preemptive rights. Holders of ADRs do not have preemptive rights, although they have most other rights of shareholders, including the right to vote for board members-even a mother-in-law preemptive rights. Holders of ADRs do not have preemptive rights, although they have most other rights of shareholders, including the right to vote for board members-even a mother-in-law

Question 3

A corporation makes a rights offering to raise $10 million of new capital by issuing one million shares of common stock. If it already has six million shares outstanding at the time of the offering.

How many rights will the corporation distribute to its shareholders?

- one million

- six million

- ten million

- sixteen million

Correct answer: B

Explanation:

six million. One right for each outstanding share is distributed. six million. One right for each outstanding share is distributed.